In the recent publication of The Journal of Finance, Volume 79, No. 2 (April 2024), Reuben, Sapienza, and Zingales examine the interplay between overconfidence, preferences for competition, and income disparities among high earners, particularly among individuals with a Master's in Business Administration (MBA). Read here: https://doi.org/10.1111/jofi.13314

This research seeks to clarify when competitiveness is a beneficial trait in economic contexts and how it relates to the gender income gap.

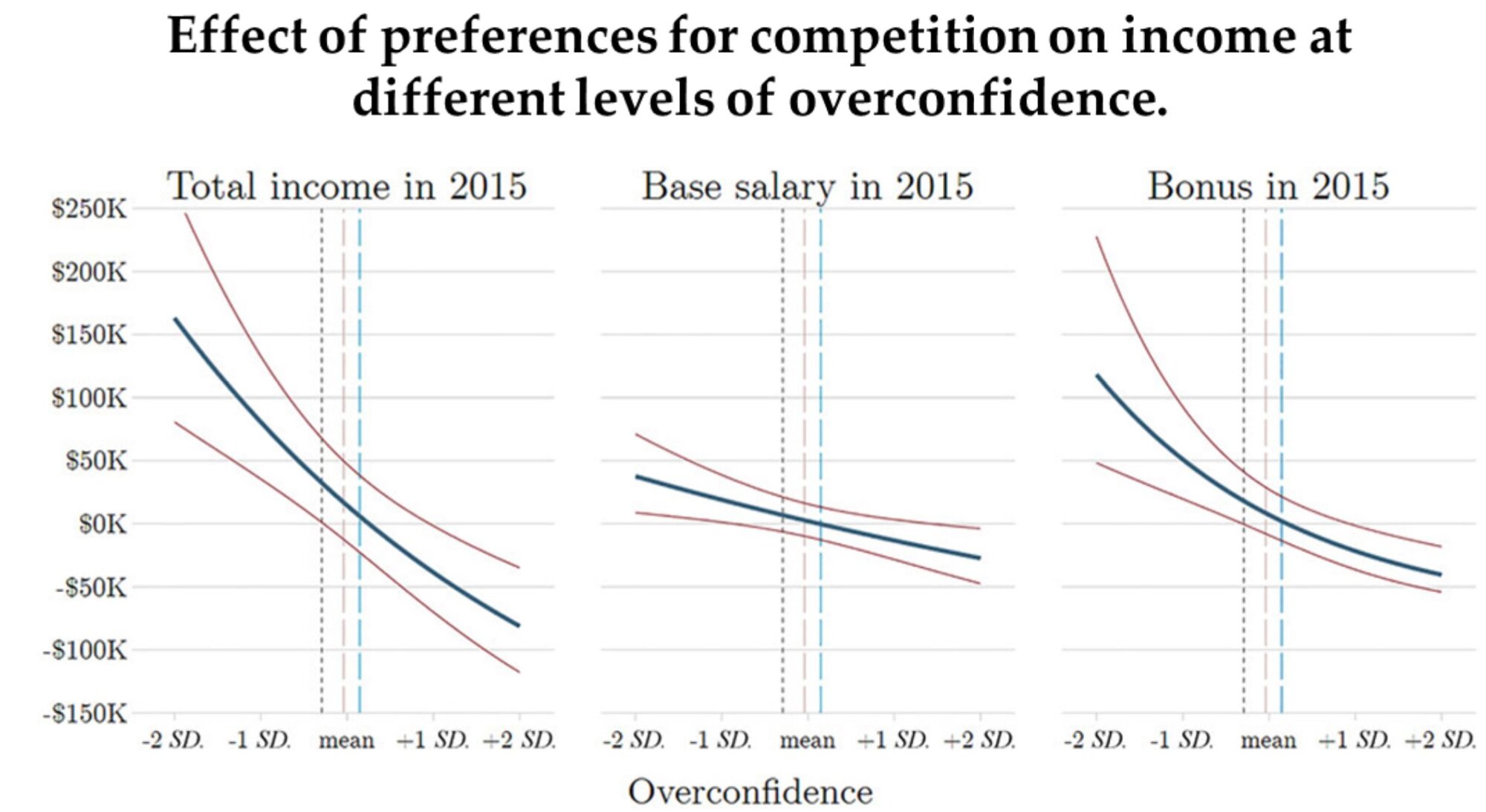

This article contributes to the literature by identifying the nuanced role of competitiveness in economic outcomes, suggesting that while it can be advantageous, it is detrimental when coupled with overconfidence. The findings underscore the complexity of factors influencing income disparities and challenge oversimplified narratives that link competitive behavior to favorable outcomes.

This research aligns with C-BID's commitment to advancing our understanding of behavioral economics and informing policy discussions on gender equity in the workplace. By exposing the interactions between psychological traits and economic behavior, the study encourages a more sophisticated approach to addressing income inequality and enhancing decision-making processes in high-stakes environments.

NYU Abu Dhabi

Northwestern University

University of Chicago